Differences and advantages of plot ownership

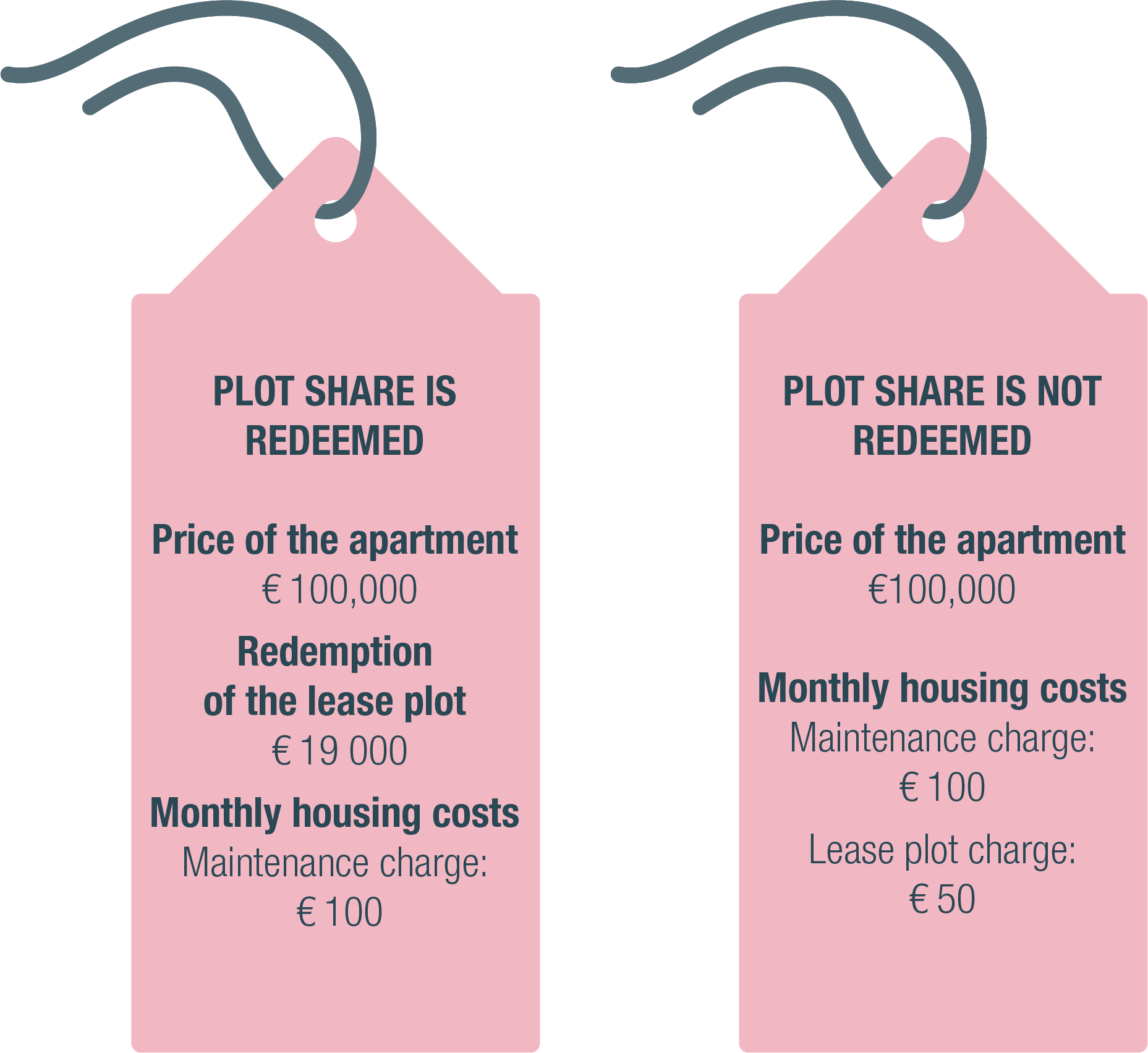

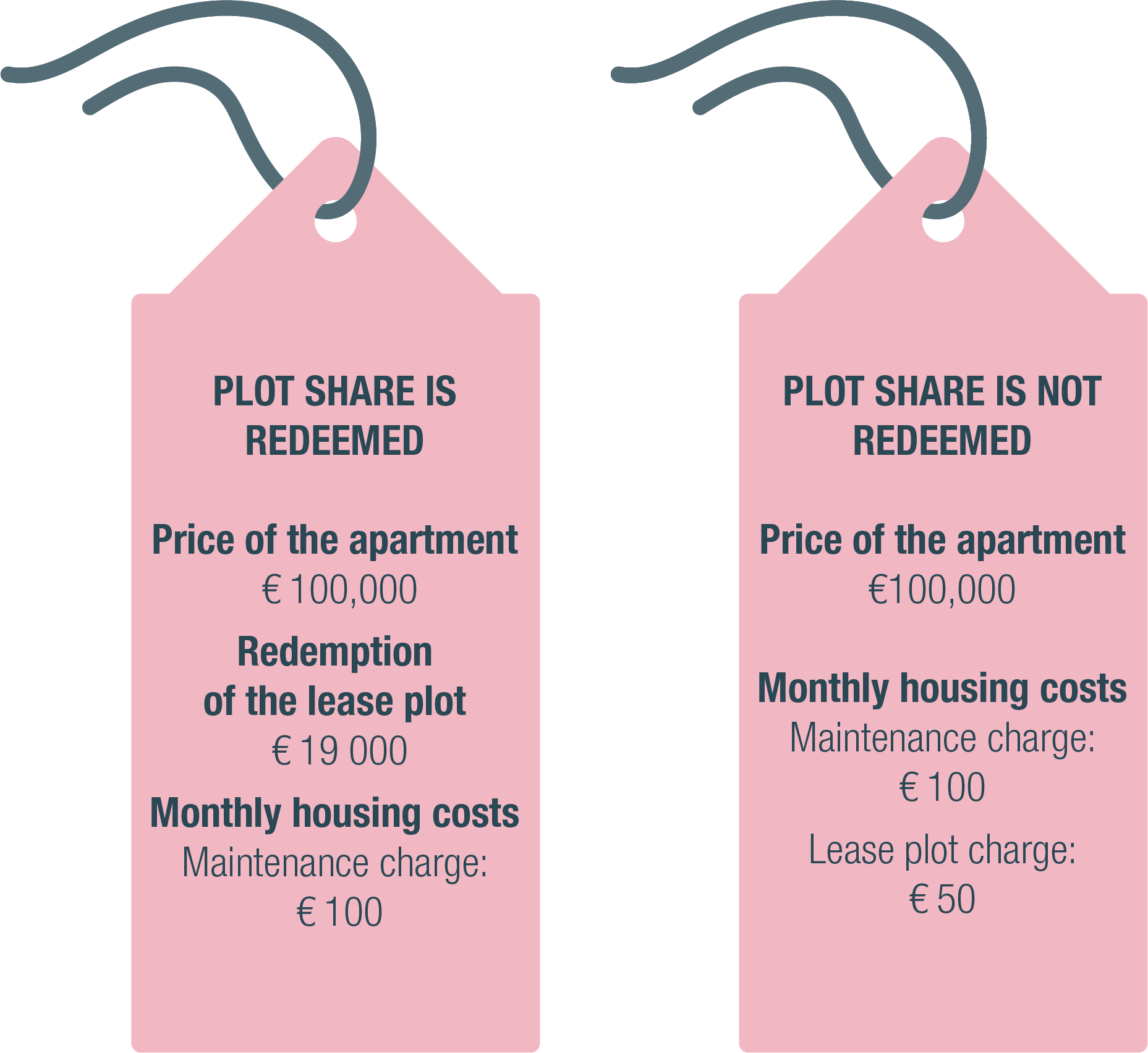

When a housing company is on a lease plot, you can buy an apartment with less capital and pay rent for the plot as part of the monthly maintenance fee. If the housing company owns its plot, you need more capital to purchase an apartment, but your monthly housing costs are lower. The optional lease plot allows you to choose for yourself what you do: whether to pay a monthly lease plot charge or redeem your share of the lease plot.

Own plot – straightforward ownership

Own plot – straightforward ownership

- The building of the housing company is built on its own plot.

- The plot is included in the price of the apartment.

- The purchase price is usually higher than in an apartment on a lease plot.

- You will not have to pay a monthly lease plot charge.

Lease plot – save money in buying your own apartment

Lease plot – save money in buying your own apartment

- You pay a monthly lease plot charge as part of the maintenance charge.

- The building of the housing company is built on a lease plot.

- The price of the apartment only includes the apartment and the housing company cannot redeem the lease plot as its own.

- The purchase price is usually cheaper than in a housing company located on a plot owned by the housing company.

Read more

An optional lease plot – flexibility according to your situation in life

An optional lease plot – flexibility according to your situation in life

- The building of the housing company is built on an optional lease plot.

- The price of the apartment only includes the apartment and the plot share can be redeemed separately.

- You can decide for yourself whether to pay the share of the plot at the time of the purchase or later.

- You pay a monthly lease plot charge until you redeem the plot share.

- After redeeming the plot share, you will be released from paying the monthly lease plot charge.

Read more about the optional lease plot

Lease plot - the plot share is not redeemable

A housing company located on a lease plot usually gives you the chance to acquire your own apartment with less capital compared to a housing company built on its own plot. The lease plot charge is included in the monthly maintenance charge of the apartment, and its share is not specified. In a housing company built on such a lease plot, you cannot redeem a plot share.

Lease plots are usually owned by, for example, cities, and lease periods are typically long, such as 50 or 100 years.

What about when the lease expires?

At the end of the lease, the housing company usually enters into a new lease with the plot owner. As a rule, leases are long and the owners of the plots are reliable.

Sometimes the owner may allow the housing company to redeem the plot, with the apartment owners being responsible for paying the purchase price. With the transaction, the plot will be transferred to the ownership of the housing company, not to an individual resident.

Read more about the rental terms and make a decision with confidence

When buying an apartment in a housing company with a lease plot, you should check the lease terms of the plot. There are differences in the lease terms for each housing company and they affect, among other things, the amount of lease. Some city-owned lease plots may also have restrictions on the resale price of the apartment. In Helsinki, some of the city's lease plots belong to the Hitas which is a price and quality level regulatory system.

Things to find out about a lease plot before making a purchase decision:

- How long is the lease of the plot valid?

- What are the lease plot terms and conditions to a housing company?

- On what basis are increases made and how often?

- Does the lease of the plot include price restrictions for the resale of the apartment?

- What does the charge per apartment consist of and what is the share of the plot in it?

- Who owns the land? As a buyer, you should know who the owner of the plot is and find out the reliability of the owner, if necessary.

- YIT enters into land lease agreements only with carefully selected parties.

You can find the form of ownership of the plot in the housing company's information on our website, and YIT Homes Sales will also help you with all questions concerning the plot.

Optional lease plot – the plot share is redeemable

An optional lease plot is flexible according to your situation in life - you decide for yourself what to do with the redemption of the plot. If you wish, you can pay the housing company the redemption share of the plot either at the time of completion of the apartment or later. If you decide to postpone the redemption of the plot, you will pay a monthly lease plot charge in addition to the maintenance charge. Remember that the payment of the lease plot charge does not reduce the redemption price of the plot share.

After redemption, you will no longer have to pay your share of plot lease or the lease plot charge, so your living expenses will be reduced. The land lease agreements of some housing companies also allow the redemption of some part of the lease plot. In this case, the lease plot charge does not disappear completely, but decreases according to the redemption share.

Use and transfer of the redemption right

We provide information on the prices and charges of apartments sold on the website of each housing company built by YIT. The redemption price of the plot is not included in the debt-free price of the apartment, but is mentioned separately in the “Redemption of the lease plot” line.

The possibility to pay the redemption share is in connection with the completion of the apartment and once a year thereafter. When exercising the right of redemption, the full redemption price must be paid at once. The land lease agreements of some housing companies also allow the redemption of some part of the lease plot.

If you sell your flat later on and have not exercised the redemption right, it will be transferred to the new owner.

Plot redemption price and taxes

When the owner of the apartment wants to redeem the plot share of their apartment, they pay the housing company the redemption amount and other fees arising from the transaction, such as the transaction confirmation fee. The housing company makes a property transaction with the owner of the plot. After the transaction, the plot share will be transferred to the ownership of the housing company, and the resident will no longer be charged any lease plot charges. The resident will also have to pay a property transaction asset transfer tax, which is 4% of the redemption price of the plot.

Also the first-time buyers must pay an asset transfer tax on the redemption of the plot. No 2% asset transfer tax for shares in a housing company is paid on redemption, even if the redemption is made in connection with the transaction.

An estimate of YIT Homes apartment-specific redemption price for the plot share can be found on the housing company's website. The final calculation of the price can be obtained either in connection with the letter of move or about a couple of weeks before the completion of the housing company. The calculation is always made by the landlord. The redemption price of the land is increased annually in accordance with the lease agreement, for example, by a change in the cost-of-living index.

The leasse plot will become the housing company's own plot when all shares of the plot have been redeemed.

Is it worth redeeming the plot share?

Redeeming a plot share may make sense as soon as the apartment is completed if you have the financial opportunity to redeem it and plan to live in the apartment for a long time. After a few years, the price of the plot share will quite certainly be higher, and the already paid lease plot charges will not reduce the redemption price. At the current interest rate level, redeeming the plot with a bank loan is also profitable compared to paying the lease plot charge.

On the other hand, if you know you will be changing your home within a few years, paying a lease plot charge may be a more profitable option than redeeming the plot share. When selling an apartment, an unredeemed share of the plot may be an advantage when the buyer can decide for themselves what to do with the plot share. Paying the lease plot charge also gives the freedom to invest the capital in something other than the redemption of the plot share.

There are values other than money in life and only you know whether it is a better option for you to redeem a plot share or pay a lease plot charge.

Familiarise yourself with the redemption terms and make the most appropriate decision for you

When buying an apartment in a housing company with an optional lease plot, you should check both the lease terms of the plot and the terms of redemption of the plot share. There are differences in the redemption terms of different housing companies – they are worth comparing! The redemption terms affect, for example, at what price and when you can redeem the plot share.[Rivityskohta]

Before buying an apartment, find out these things about an optional rental plot:

- How is the redemption price determined? Are there any expected increases in the redemption price?

- If you do not redeem the plot share in connection with the transaction, when will it be possible next time?

You can find the form of ownership of the plot in the housing company's information on our website, and YIT Homes Sales will also help you with all questions concerning the plot.

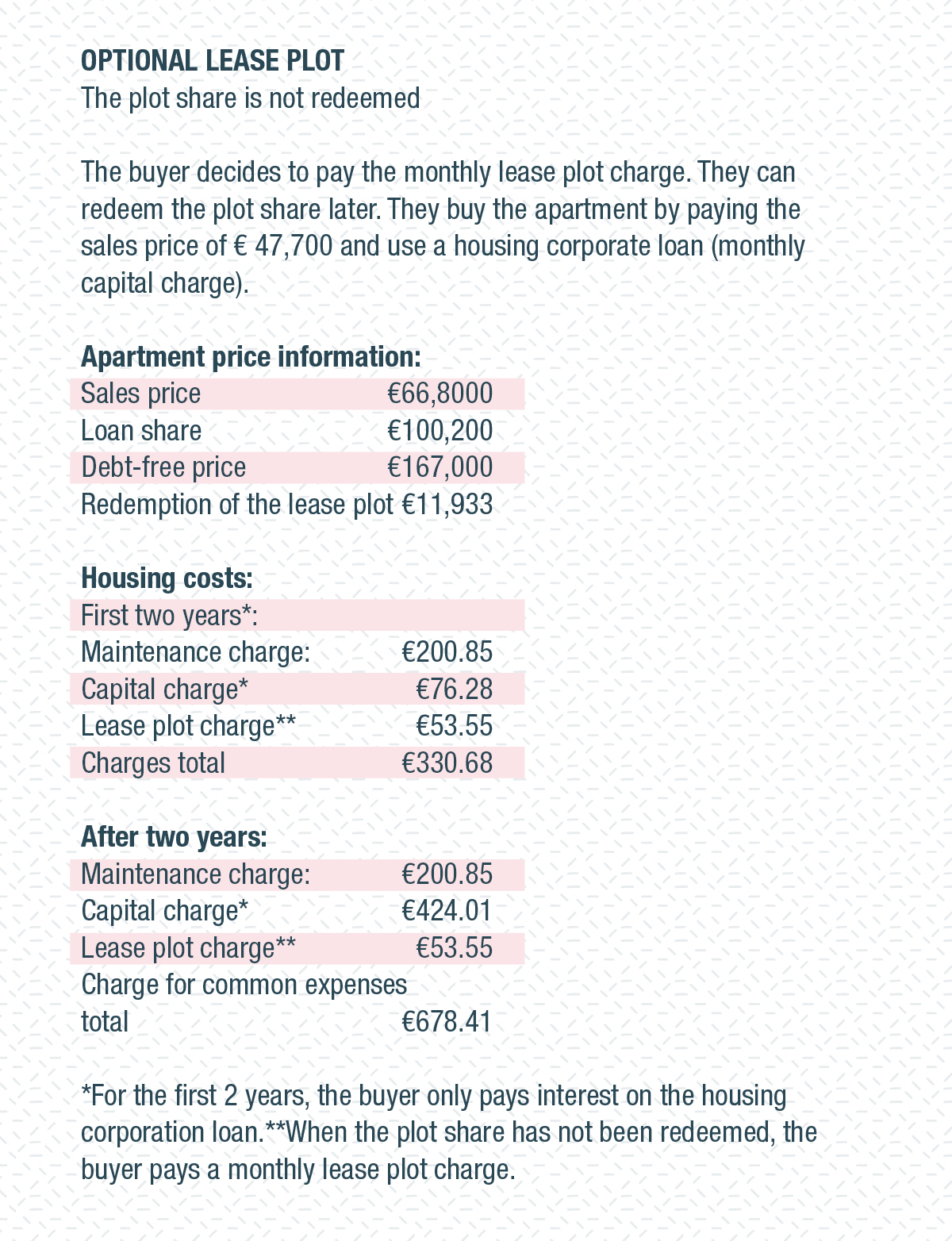

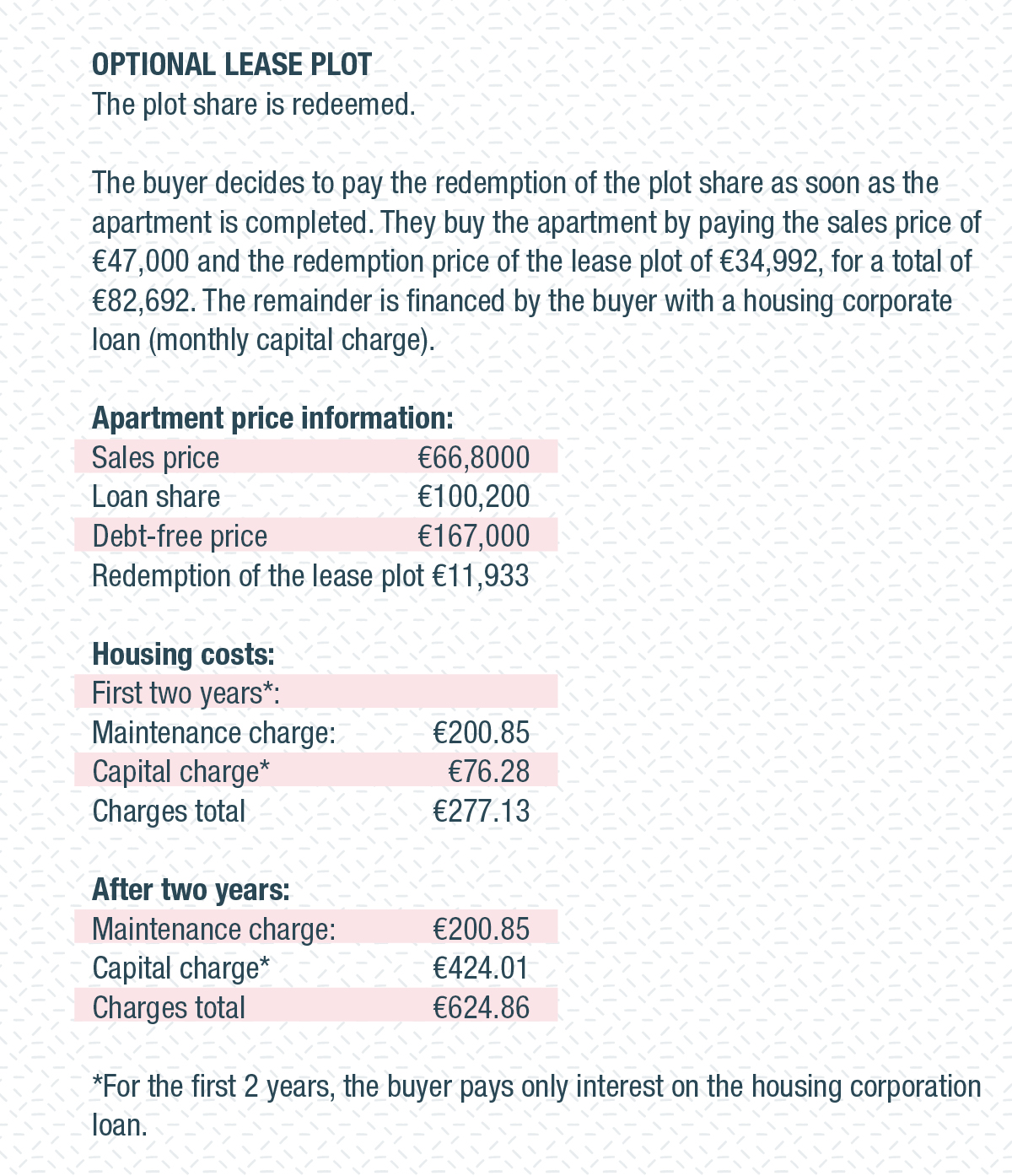

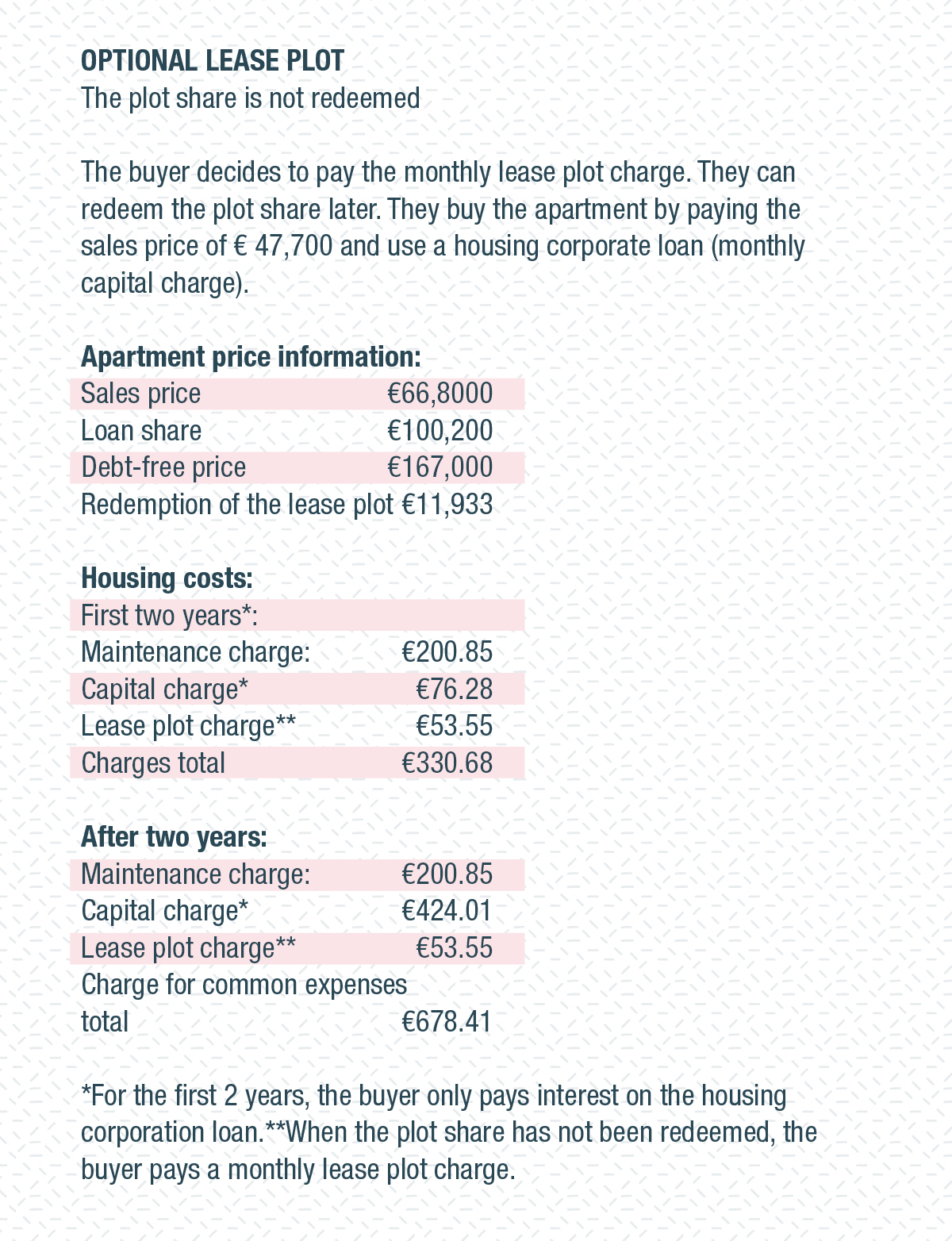

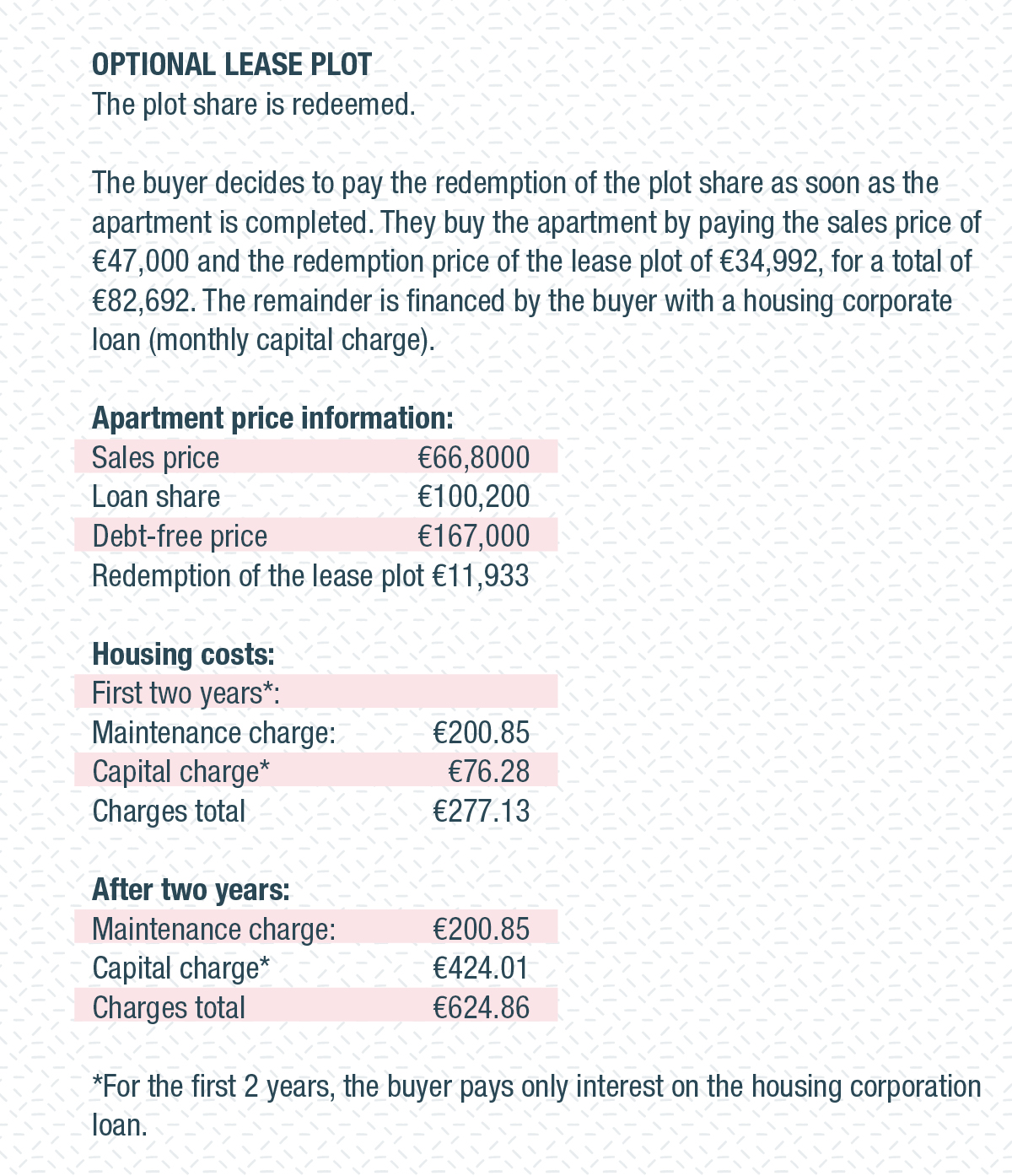

This is how the redemption of a plot share affects costs

See how redeeming a lease plot share affects the price of an apartment and your housing costs. Our example home is a 41.5 m2 flat in Jyväskylän Marleena housing company in Jyväskylä.)

Do you have any questions about plot ownership? Contact YIT Homes Sales.